online banking

We want to make your credit union

more accessible to you than ever before.

Online Banking Features

Easy Login

Fast app Login with Touch or Face ID (depending on device).

End To End Loans

Manage your loan application online from start to finish.

Bill Payments

Pay your utility bills easily with online and mobile banking.

Upload Documents

Upload and sign documents securely for your loan applications.

Print Statements

View account balances and print statements.

Contact Us

Chat with us directly from any device for support and queries.

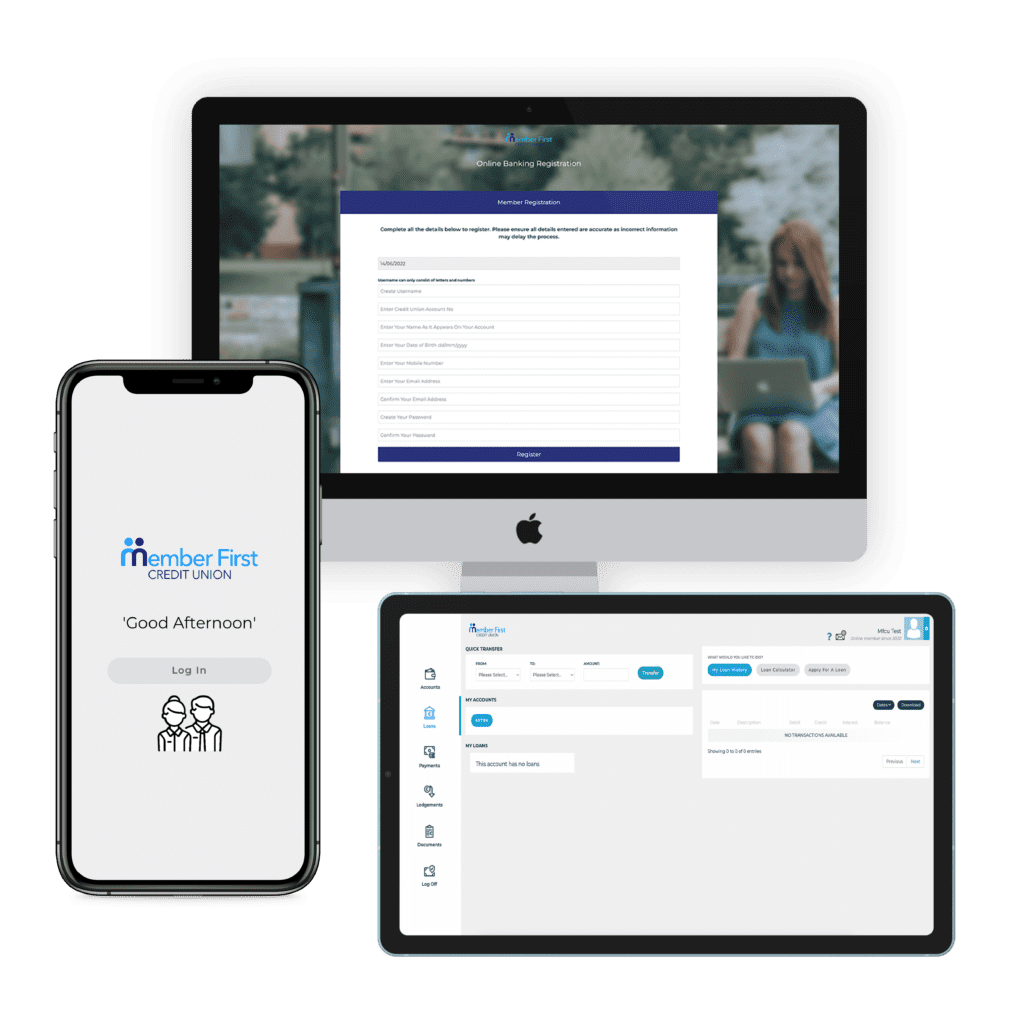

MFCU mobile

- Easy Login (Touch or Face ID)

- Check account balance

- Pay bills

- Download statements

- End to End Loans

- Upload documents

MFCU Desktop

- 24/7 banking

- Transfer Funds to any account

- Manage your MFCU account

- Apply for a loan

- Pay bills

FAQ

If you’re having trouble with Online Banking, you’ll find a full library of FAQs on our Help Page, include below:

Of course, we are always here to help if you continue to have issues with our online banking services. Contact us at (01) 851 3400 or chat to us on our website Live Chat today to speak to our Member Services Team.

In order to receive your OTP via Push Notification, Android users must change their notification settings on their device. To enable push notifications on Android phones:

- Download the MFCU app (click here to download)

- Go to ‘Settings’ on your phone and navigate to ‘Notifications’

- Select ‘View All’ to view app notification settings

- Click ‘MFCU’ and allow all badges/notifications

How do I get access to Online Banking?

To get access to your Member First Credit Union account online, you’ll first need to register. Once you’ve completed the application, a confirmation email will be sent to the email address you have provided.

Your new PIN number will be sent to you by secure SMS, so it’s important that you have your contact details up to date. Once you have received your PIN, you can login to CU Online right away. You will also receive a One-Time Passcode (OTP) to your mobile number each time you login for enhanced security.

With Online Banking you will be able to transfer funds, view and print statements, and check account balances.

Once you have signed up for Online Banking with Member First, you can transfer funds to and from this account online. Please note that transfers can take up to 3 working days to be processed.

All Member First Credit Union accounts are eligible for free online access. You can register for online access to your account at the link below.

Please note that proof of ID and proof of address need to be up-to-date to allow members to transfer funds electronically.

How do I get a printed statement for my account?

Statements are available on demand from your online area. You can select the required time period and download your statement as a PDF to print. You can find a tutorial for downloading statements from your MFCU Mobile App here and for desktop online banking here.

If required, you can also request a printed statement from any MFCU branch for a small fee.

Please note we no longer issue annual account statements by post.

Online help

Need help with our Mobile App and Desktop? We have Tutorials available to help you manage your MFCU online account.